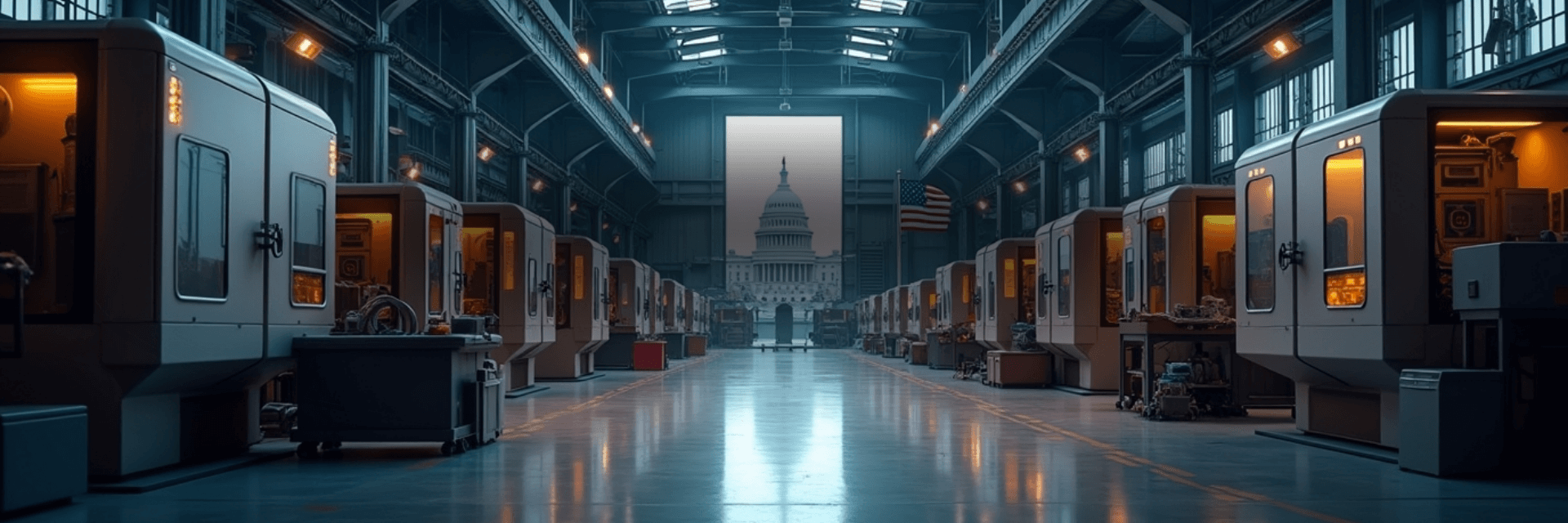

Impact of

One Big Beautiful Bill Act

on Manufacturing Industry

President Trump signed the “One Big Beautiful Bill Act” into law on July 4th, 2025. Among all its effects, the bill is also expected to impact the manufacturing industry, as it includes provisions specifically tailored to it. The bill has both benefits and drawbacks for the United States manufacturing industry, and this article will outline them in detail.

Benefits of ‘One Big Beautiful Bill’ on the manufacturing industry:

Let’s start discussing some of the benefits that you can get due to ‘One Big Beautiful Bill’, if you are in the manufacturing industry:

- Immediate tax deduction: This provision is for how companies can account for the cost of their new assets. A Manufacturing business can now deduct all the costs of buying new machinery, upgrading, or building a factory instantly in the same year of making the investment. Previously, they had to deduct the cost over many years. With this bill, now a manufacturing business owner can get the price of equipment and even entire factories deducted immediately, if the assets are placed after 19th January 2025. This will help put the money faster in the hands of businesses, helping them to reinvest more money in their businesses.

- R&D incentives: Research and development are essential for any business to beat its competition and stay relevant over time. This bill is also trying to encourage more businesses to invest in R&D. If a company is spending any amount of money on R&D of their products in the USA, then they will be able to deduct that cost immediately. This is to inspire more people to invest more in innovation and get tax cuts for that, helping to make the US manufacturing market more creative and competitive.

- Interest deductions: The bill is also going to help with easing limitations on how much interest a company can deduct on loans. This is very important for manufacturers because they often need to borrow large amounts of money to fund their expansion. The old method of deducting business interest using the EBITDA has been restored through the help of this bill.

- Targeted incentives: Other than the general benefits that are there for manufacturing, the government is giving targeted incentives to strengthen some sectors, like the semiconductor manufacturing industry. Every country is now focused on making the best semiconductors. The bill has increased the semiconductor manufacturing tax credit (Section 45D) from 25% to 35% for qualified semiconductor manufacturing property placed in service after December 31, 2025. This will be applicable for facilities that manufacture semiconductors or semiconductor manufacturing equipment.

Drawbacks of the One Big Beautiful Bill Act:

Here are some drawbacks of the ‘One Big Beautiful Bill Act’ on the manufacturing sector:

- Changes to energy policy: This new bill has brought some changes to different clean energy tax credits of the previous administration, which might hurt the businesses that are involved in wind, solar, and hydrogen energy sector manufacturing. It also extends the credit for clean fuel production. Manufacturers who are heavily invested in these sectors are worried they might face economic problems due to unfavourable business conditions.

- Complexity to the tax code: The bill has added different new rules and regulations, which might make your tax filing journey a bit more complicated and difficult. For example, the bill has newly introduced “foreign entity of concern”, as per which someone can be denied tax credit for projects that use too many components from certain foreign countries.

What should the manufacturers do?

There is now finally an opportunity for manufacturing companies to grow at the fastest speed, so here are some steps that they can follow to get the best benefits:

- Accelerate growth: If you were planning to grow and expand your services by entering new markets or just increasing your production volume, then this might be the best opportunity for you, because you will be able to get tax benefits on all the investments you’re going to make.

- Model scenarios carefully: Though tax evasions have been declared in the bill, you must still evaluate the scenario carefully before putting in a big amount by weighing bonus depreciation and section 179 expenses against long term plans and tax liability.

- Timing: Align large capital projects with optimal timing to maximize the immediate deductions.

- Green energy problem: If you are in the green energy manufacturing industry, then the bill may not be favorable for you, but you can continue to manufacture and sell, as there is demand for these products among the masses, and various EV companies also need them.

- Consult taxation experts: The one thing you need to do is consult your accountant or tax lawyer before making any move, as the taxation system is quite complex. It’s better to seek expert consultation.

Conclusion:

The bill is about bringing back manufacturing to the United States of America by giving different incentives and benefits, but the bill can also harm the manufacturing businesses involved in green energy manufacturing. Anyway, if you are already in manufacturing or planning to get into it, then you must check our used CNC machines collection for great machines at affordable prices.